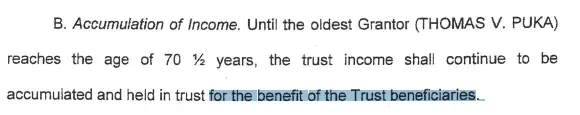

In the Marge Puka Irrevocable Trust instrument, Marjorie clearly expressed to her team of trust advisors — over the course of several weeks and several meetings, to make Marjorie look poor to prevent Medicaid from taking the assets Thomas and Marjorie intended to leave equally to her three daughters’, Janette, Denise, and Charmelle.

In an older trust that Denise was trustee for nearly 20 years established the intention of Thomas AND Marjorie who are the father and mother of Janette, Denise, and Charmelle.

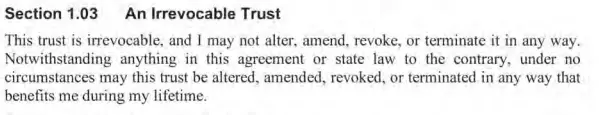

Is Marjorie Allowed To Terminate This Trust And Get Benefits In Her Lifetime?

Based on the clause you provided, Marjorie is not allowed to terminate or modify the trust to benefit herself during her lifetime.

The trust is explicitly stated to be irrevocable, and the language clearly prohibits any alteration, amendment, revocation, or termination that would result in a benefit to Marjorie while she is alive.

This kind of language is typically used in trust documents to ensure that the trust’s terms and purposes are maintained throughout its duration, without interference from the grantor.

What Happens If Marjorie Terminates The Trust During Her Lifetime And Receives All The Benefits And Control Over All The Trust Assets?

If Marjorie terminates the trust during her lifetime and takes control of all the trust assets, despite the trust being irrevocable and explicitly stating she cannot benefit from such actions, there could be several consequences:

- Legal Challenges: Beneficiaries or interested parties could challenge her actions in court, as they go against the trust’s terms.

- Invalidation of Actions: A court might invalidate any actions taken by Marjorie to terminate the trust or transfer assets to herself, as they would be in direct violation of the trust’s terms.

- Legal Liability: Marjorie could face legal liabilities for breaching the trust agreement, which might include financial penalties or other legal repercussions.

- Tax Implications: There could be significant tax implications, as irrevocable trusts often have tax benefits that are contingent on the trust not being altered or terminated.

These outcomes would depend on the specific laws and judicial decisions applicable in the jurisdiction where the trust was established and is being administered.

Legal advice from an attorney specializing in trust and estate law would be essential in such a scenario.

What Is Alienation?

In legal terms, “alienation” refers to the act of transferring property, such as real estate or personal property, from one party to another.

This transfer can occur through various means, including sale, gift, or inheritance.

Alienation often involves a change in ownership and the rights associated with the property.

In the context of a trust, alienating trust property would mean transferring it out of the trust, thereby changing its ownership or control contrary to the terms of the trust.

Who Benefited From Marjorie’s ‘Alienation’ Of Trust Property?

To determine who benefited from Marjorie’s ‘alienation’ of trust property, it would be necessary to look at who received the trust assets after she allegedly terminated the trust and took control of them.

Typically, the beneficiary in such a scenario would be the person or persons to whom the assets were transferred or who gained control over them.

This could be Marjorie herself, if she appropriated the assets for her own use, or others to whom she might have distributed the assets.

However, without specific details about the transfer of assets or the beneficiaries, it’s not possible to identify who benefited.