—-

Link to the written Timeline Of Events in the Powers v. Puka lawsuit.

Below is a Visual Timeline Of Events.

—-

From Petty Conflict To Courtroom: Denise’s Case Against Janette

Trust Situation Overview

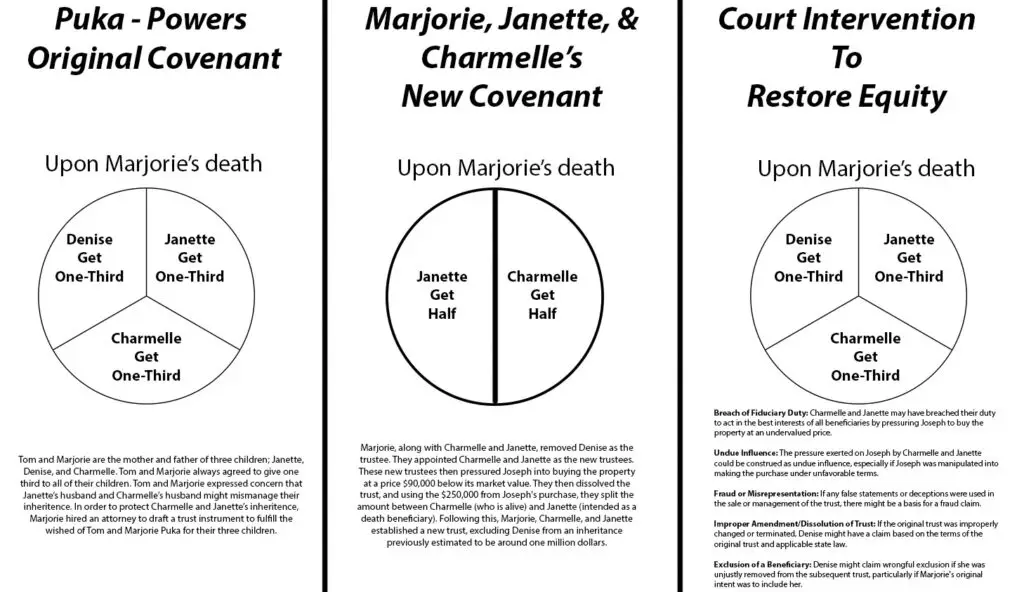

Marjorie Puka is the grantor of a trust. Initially, Denise was both the first trustee and the primary beneficiary. The trust also includes two successor trustees and beneficiaries: Charmelle Puka (second) and Janette Golay (third).

Marjorie asked family members, Joseph, Lucinda, and Amrita (who are not mentioned in the trust instrument), to live in and maintain a particularly important piece of trust property. The plan was for Joseph et al., to live there until Marjorie’s death. At that point, the property’s value would be determined, and this amount would be deducted from Denise’s share of the inheritance, which she shares with Charmelle and Janette.

However, Marjorie, along with Charmelle and Janette, removed Denise as the trustee. They appointed Charmelle and Janette as the new trustees. The new trustees then pressured Joseph into buying the property at a price $90,000 below its market value. They then dissolved the trust, and using the $250,000 from Joseph’s purchase, they split the amount between Charmelle (who is alive) and Janette (intended as a death beneficiary). Following this, Marjorie, Charmelle, and Janette established a new trust, excluding Denise from an inheritance previously estimated to be around one million dollars.

Potential Legal Questions

- Did Joseph, by living in and caring for the trust property, establish a fiduciary relationship with Marjorie, the trustees, or any of the beneficiaries?

- Was Joseph expected to preserve and protect the property for the benefit of the trust and its beneficiaries?

Potential Claims: Based On The Situation

- Breach of Fiduciary Duty: Charmelle and Janette may have breached their duty to act in the best interests of all beneficiaries by pressuring Joseph to buy the property at an undervalued price.

- Undue Influence: The pressure exerted on Joseph by Charmelle and Janette could be construed as undue influence, especially if Joseph was manipulated into making the purchase under unfavorable terms.

- Fraud or Misrepresentation: If any false statements or deceptions were used in the sale or management of the trust, there might be a basis for a fraud claim.

- Improper Amendment/Dissolution of Trust: If the original trust was improperly changed or terminated, Denise might have a claim based on the terms of the original trust and applicable state law.

- Exclusion of a Beneficiary: Denise might claim wrongful exclusion if she was unjustly removed from the subsequent trust, particularly if Marjorie’s original intent was to include her.

How Does Joseph’s Preservation Of Trust Property Benefit The Grantor And Beneficiaries?

The idea is that Joe would occupy the trust property until the grantor passed.

Upon the grantor’s passing, the value of the house would be calculated at the time of the grantor’s death, and the value of the home would be subtracted from Denise’s portion of her inheritance that’s split with two others, Janette and Charmelle.

Scenario

Marjorie, the grantor, requests that Joseph live in and maintain a significant property of the trust.

By the time of Marjorie’s death, the trust property (house) might be worth approximately $450,000, and the remaining trust assets sum up to $3,450,000, making the total trust worth approximately $3,450,000.

Benefits Of Joseph’s Actions

- Property Value Preservation: By Joseph living in the property, it is less likely to become a target for vandalism, theft, or other damages that can occur in vacant properties. An occupied home is also less likely to suffer from neglect-related damages.

- Property Value Appreciation: Active maintenance and upkeep by Joseph can lead to appreciation in the property’s value. Regular repairs, maintenance, and ensuring the home’s overall good condition can all positively influence the property’s market value.

- Reduced Costs for the Trust: If Joseph takes care of both major and minor repairs and maintenance using his own resources, it means the trust doesn’t have to pay for these expenses. Over time, this can amount to significant savings, benefiting all beneficiaries.

- Ensuring Asset Liquidity: Should the trust need to liquidate assets, a well-preserved property can be sold more quickly and potentially at a higher price than a neglected one.

- Peace of Mind for the Grantor: The grantor, having placed the property in trust, likely did so with the intention of benefiting the beneficiaries. Knowing the property is well-maintained aligns with the grantor’s intent and provides peace of mind that their wishes are being honored.

- Upholding Fiduciary Duties: Trustees have a fiduciary duty to protect and preserve trust assets for beneficiaries. Joe’s actions in preserving the property support the trustees in fulfilling this duty.

Financial Implications For Denise

Upon Marjorie’s death, the value of the house would be deducted from Denise’s share.

The approximate total value of the trust, inclusive of the house, is $3,450,000. If Denise, Charmelle, and Janette are to equally split the inheritance, each would ordinarily receive $1,150,000 (i.e., $3,450,000 ÷ 3).

However, there’s a stipulation that the value of the house, which is $450,000, be deducted from Denise’s portion:

- Ordinary Inheritance for Each Beneficiary: Without any deductions, each beneficiary—Denise, Charmelle, and Janette—would receive $1,150,000 from the trust.

- Adjustment for Denise: Given the house’s $450,000 value, Denise’s inheritance will be reduced by this amount: $1,150,000 (her initial share) – $450,000 (house value) = $700,000. Therefore, Denise’s total inheritance will be $700,000.

- Inheritance for Charmelle and Janette: Both Charmelle and Janette would each inherit their original amount of $1,150,000.

Financial Consequences For Denise Following Her Exclusion From The Inheritance By Janette and Charmelle

- Sale of the House: Joseph buys the house for $250,000 (instead of its worth of $450,000), this means there’s a deficit in the trust’s total value of $200,000 (because the house was undervalued by this amount in the sale).

- New Trust Value After Sale: $3,450,000 (original value with house) – $200,000 (undervaluation) = $3,250,000

- Division between Charmelle and Janette: If Denise was tricked out of her inheritance and Charmelle and Janette split the inheritance 50-50, they would divide the $3,250,000 equally. Janette and Charmelle would receive $3,250,000 ÷ 2 = $1,625,000 each.

In this scenario:

- Denise would receive $0.

- Charmelle would inherit $1,625,000.

- Janette would also inherit $1,625,000.

Denise did not benefit from Joseph buying the house at an undervalued rate.

Financial Losses To The Trust Due To Actions Of The New Trustees – Charmelle & Janette

- First Property Sale:

-

-

- The property was sold for $250,000.

- If the house’s estimated value was $450,000 at the time of death, the sale resulted in a loss of $200,000.

-

- Second Property (Stadium House) Sale:

-

-

- The total cost of the house (purchase plus upgrades) was $640,000.

- The sale price was $527,000.

- After deducting realtor fees and other associated costs ($40,000), the net from the sale was $487,000.

- Thus, the financial loss on this property sale was: $640,000 (cost) – $487,000 (net from sale) = $153,000.

-

- Combined Losses:

-

- The total loss from both properties: $200,000 (first property) + $153,000 (second property) = $353,000.

In summary: The combined financial loss from the two property sales was $353,000, and each beneficiary’s inheritance was reduced by another $106,000.

Did Joseph, By Living In And Caring For The Trust Property, Establish A Fiduciary Relationship With Marjorie, The Trustees, Or Any Of The Beneficiaries?

The establishment of a fiduciary relationship hinges on the nature of the obligations and duties that Joseph undertook or were imposed upon him and whether those duties were owed to the trust or its beneficiaries.

- Express Agreement: If there was an express agreement (written or verbal) between Joseph and Marjorie, the trustees, or any beneficiaries that laid out duties and responsibilities for Joseph in relation to the trust property, this could establish a fiduciary relationship.

- Implied Duties: Even in the absence of an express agreement, if it was understood by all parties that Joseph was living in the property to maintain, protect, or enhance its value for the benefit of the trust or its beneficiaries, this could imply a fiduciary duty.

- Nature of Actions: If Joseph undertook actions that went beyond mere occupancy — such as significant maintenance, repairs, or other activities that clearly benefited the trust or its beneficiaries — these actions might be evidence of a fiduciary role.

- Standard Practices: If it’s standard practice in the relevant jurisdiction or context for someone in Joseph’s position to have fiduciary duties, this could suggest a fiduciary relationship.

However, simply living in a property, without more, typically doesn’t create a fiduciary relationship.

The key is whether Joseph had duties concerning the trust property that were intended to benefit the trust or its beneficiaries.

Was Joseph Expected To Preserve And Protect The Property For The Benefit Of The Trust And Its Beneficiaries?

To determine whether Joseph was expected to preserve and protect the property for the benefit of the trust and its beneficiaries, one would need to consider the following factors:

- Express Agreement: If there was a written or verbal agreement between Joseph and the grantor, trustees, or beneficiaries outlining Joseph’s duties related to the trust property, this would be the clearest indicator of his expected responsibilities.

- Implied Expectations: Even without a formal agreement, there might have been mutual understandings or expectations communicated between Joseph and the relevant parties. For instance, if Marjorie or the trustees regularly spoke to Joseph about maintaining the property or if Joseph routinely sought and received approval for maintenance tasks, this could suggest implied duties.

- Conduct and Actions: If Joseph consistently took actions to maintain, repair, or enhance the property and these actions were known to and approved by the trustees or beneficiaries, it could indicate an expectation of his role to protect the property.

- Nature of the Property: Given the property’s deep sentimental value to the grantor, stemming from her history with her late husband and their shared experiences in the home, there may be an inherent expectation for meticulous care and preservation, beyond just its physical characteristics or maintenance needs.

- Comparison to Similar Situations: If it’s common in similar circumstances for an occupant to have such duties, it could suggest Joseph was expected to uphold similar responsibilities.

However, without specific evidence or indicators of such an expectation, one cannot definitively conclude that Joseph had this responsibility.

A clear understanding would likely require a review of any communications, agreements, or conduct related to Joseph’s occupancy of the trust property.

Does The Sentimental Value And History Of The Property, Specifically Its Significance To The Grantor Due To Her And Her Late Husband Building And Living In It, Factor Into The “Nature” Of The Property And The Expectations For Joseph’s Care And Preservation?

Absolutely, the emotional or sentimental value of a property can indeed be considered part of its “nature” when discussing its significance to the grantor and, by extension, its importance within a trust.

The express sentimentality attached to the property—such as it being “super special” due to its history and the memories it holds for the grantor—heightens the perceived value and importance of preserving it. This isn’t merely about monetary value but emotional and sentimental value, which can be just as, if not more, significant to some grantors and beneficiaries.

Given this context:

- Emotional Attachment: The fact that the grantor and her late husband built the home together and spent a significant portion of their life there would naturally enhance the importance of its preservation. This house isn’t just a building; it’s a repository of cherished memories and experiences.

- Explicit Request to Joseph: The grantor’s specific request for Joseph to care for the property underscores its importance to her. This is not a casual or incidental decision but a deliberate choice, likely rooted in trust and the understanding of the property’s significance.

- Grantor’s Visitation Rights: The arrangement allowing the grantor to visit the property whenever she wished further highlights its sentimental value. It wasn’t merely an asset to be managed; it was a place she wanted to continue to experience and enjoy.

Given this context, the “nature” of the property isn’t just about its physical characteristics or requirements for maintenance but deeply tied to its emotional and sentimental value to the grantor. This could indeed factor into expectations or understandings about the preservation and care of the property.

What Potential Counterclaims Might Marjorie, Janette, And Charmelle Have Against Denise And Joseph?

- Breach of Fiduciary Duty (against Denise): If Denise was the original trustee, Marjorie, Janette, and Charmelle might allege she failed in her fiduciary responsibilities in some way, leading to her removal as a trustee.

- Interference with Trust Administration (against Denise and Joseph): They could claim that Denise and/or Joseph took actions that interfered with the proper administration of the trust.

- Trespass or Unjust Enrichment (against Joseph): If Joseph’s occupancy of the trust property wasn’t explicitly allowed by the trust or by a separate agreement, they might claim he wrongfully benefited from living in the property.

- Conspiracy: They might claim that Denise and Joseph conspired together to undermine the trust or its assets.

- Breach of Contract (against Joseph): If there was a separate agreement (written or verbal) between Joseph and any of the other parties regarding the property’s upkeep or terms of occupancy, and Joseph failed to uphold his end, they could claim breach of contract.

- Indemnification (against Denise): If there were any losses to the trust that arose from Denise’s actions while she was trustee, they might seek indemnification (compensation for those losses).

- Emotional Distress: If the actions of Denise and Joseph caused significant emotional turmoil for Marjorie, Janette, or Charmelle, they could potentially claim damages for intentional infliction of emotional distress.

- Waste or Damages to Trust Property (against Joseph): If the property suffered any damage or neglect under Joseph’s care, they might seek compensation for the decreased value or costs of repairs.